Mastering the Market Cycle - Howard Marks

Author: Howard Marks

Status: Draft - still adding to it

Topics covered:

Why Study Circles

The Nature of Cycles

The Regularity of Cycles

The Economic Cycle

Government Involvement with the Economic Cycle

The Cycle in Profits

The Pendulum of Investor Psychology

The Cycle of Attitudes Toward Risk

The Credit Cycle

The Distressed Debt Cycle

The Real Estate Cycle

Putting It All Together-The Market Cycle

How to Cope with Market Cycles

Cycle Positioning

Limits on Coping

The Cycle in Success

The Future of Cycles

The Essence of Cycles

Why Study Cycles?

Generating average investment performance, is easy. Generating above average investment performance is hard.

Few people actually know the macro future better than others

Only when you know better than others can you achieve better than average returns

So trying to predict macro future and using that to achieve superior investment results is unlikely.

So what areas should we spend trying to understand more:

Trying to know more than others about what I call “the knowable”: the fundamentals of industries, companies and securities,

Being disciplined as to the appropriate price to pay for a participation in those fundamentals, and

Understanding the investment environment we’re in and deciding how to strategically position our portfolios for it.

The first 2 topics Is essentially security analysis and value investing

Figuring out what an asset can produce into the future (usually in terms of earnings or cashflow), and what those prospects make the asset worth today.

Value investors are trying to take advantage of the discriepancy between “price” and “value”.

They do this by Quantifying an asset’s intrinsic value and how it’s likely to change over time”

Assess how the current market price compares with the asset’s intrinsic value

Then build a portfolio with these value investments with minimised downside risk.

The best way to optimise the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressiveness and defensiveness.

Aggressiveness and defensiveness balance should be adjusted over time in response to change in the state of the investment environment where a number of elements stand in their cycles.

It is key to understand the “tendencies” of market cycles

If factors that influence investing were regular and predictable we would talk about what “will happen”.

Rather we talk about what might happen - “tendencies”

Risk is often talked about, but there is no universal agreement of what risk is or what it should imply for investors’ behaviour

Some people think risk is the likelihood of losing money

Others think risk is the volatility of asset prices or returns (academic thinking)

Howard Mark (and Warren Buffet) lean towards the first. Which is the likelihood of permanent capital loss.

There is also Opportunity Risk

The likelihood of missing out on potential gains.

Needs to be finished

The Nature of Cycles

Events of a cycle shouldn’t be viewed merely as each being followed by the other. Each even causes the next.

Cycles vary in terms of reasons and details, and timing and extent, but the ups and downs (and the reasons for them) will occur forever, producing changes in the investment environment - and thus in the behaviour that’s called for.

Often the reason for cycles:

In the short term: investor psychology has a large impact.

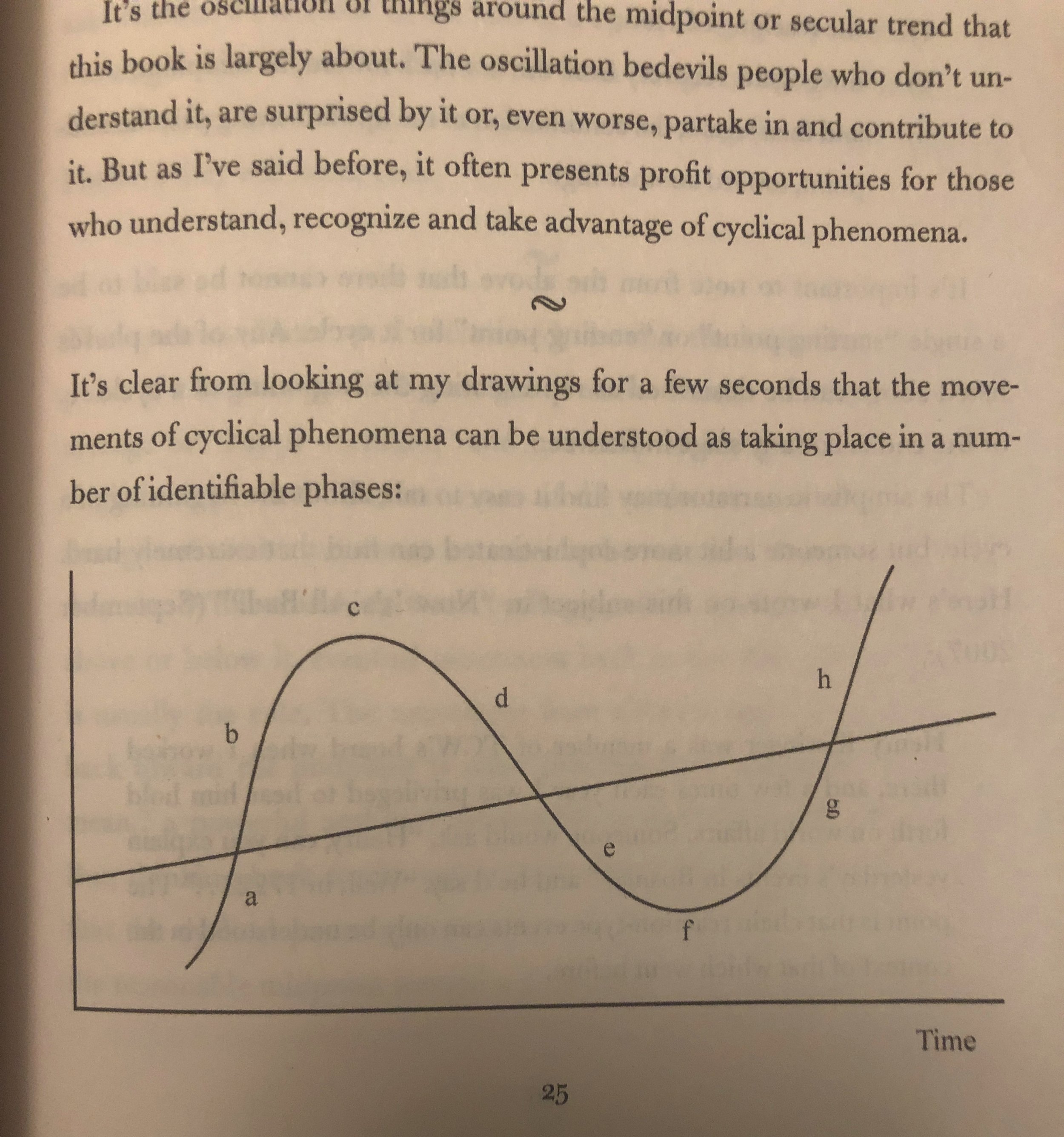

Image of market cycles from, Mastering the Market Cycle by Howard Marks, page 25

Description of each point in the market cycle from, Mastering the Market Cycle, Howard Marks, page 26.

There is no clear “end” or “start” to a cycle.

Cycles oscillate around the midpoint.

There is usually a secular trend that the cycle oscillates around

Often when extremes occur there is reversion to the mean.

But often the trend doesn’t stay at the midpoint, it continues on, sometimes onward to the next extreme.

The details vary - the timing, duration, speed and power and reasons for the swings

Markets rarely go from “underpriced” to “fairly priced” and stop there.

Usually the fundamental improvement and rising optimism that causes markets to recover from depressed levels remain in force, causing them to continue right through “fairly priced” and onto “overpriced”.

The Real Estate Cycle

The period between the start of planning and the opening of a building is often long enough for the economy to transition from boom to bust. Projects started in the good times often open in bad times, meaning their space adds to vacancies, putting downward pressure on rents and sale prices. Unfilled space hangs over the market.

Then bad times cause the level of building activity to be low and the availability of capital for building to be constrained.

Initiating a realestate project in boom times can be a source of risk. Buying them in weak times can be very profitable.

People often don’t take into account what others are doing in their decision making process

How to cope with market cycles

The investor’s goal is to position their capital so as to benefit from future developments.

They want to have more invested when the market rises than when it falls and to own more of the things that rise more or fall less and less of the others.

First step is to decide how you will deal with the future.

Some people believe in economic and market forecasting and in taking the actions that such forecasts demand. Meaning they invest more aggressively when forecasters demand and vice Vera’s.

This is generally difficult to do consistently and deliver above average results. People generally became famous for periods of time but then get it wrong over future periods.

The next best alternative is to look at where the market is in it’s cycle and what it implies for future movements.

“We may never know where we’re going, but we’d better have a good idea where we are”

To do that we need to have a good understanding of:

What causes their movements

What causes them to progress towards peaks and troughs

What causes them to retreat from those extremes

Key elements to pay attention to - generalities that affect cycles of all kinds:

The tendency of basic themes to repeat and history to rhyme;

The tendency of things to rise and fall, especially those determined by human nature;

The way each development in a cycle has implications for the next;

The way the various cycles interact and influence each other;

The role of psychology in pushing cyclical phenomena beyond rational levels

Thus the tendency of cycles to go to extremes

Their tendency to move from extremes back toward a midpoint and,

The regularity with which that movement continues past the mid-point, toward the opposite extreme.

Specific elements that influence the market cycle:

The economic and profit cycles that shape the investment environment

The tendency of psychology to overreact to developments in the environment

The way risk is considered non-existent and benign at some times, and then enormous, inescapable and lethal at others; and

The way market prices reflect only positives and overstate them at one point, and then reflect only negatives and ignore all the positives at another.

The upward movement of of prices from fair value to excess usually is related to the presence of some combination of important elements:

Generally good news

Complacency regarding events

Uniformly upbeat treatment by the media

The unquestioning acceptance of optimistic accounts

A decline in skepticism

A dearth of risk aversion

A wide-open credit market

A positive general mood

The collapse of prices from fair value to bargain levels is usually seen through:

Generally bad news

Rising alarm regarding events

Highly negative media accounts

The wholesale acceptance of scare stories

A strong rise in skepticism

A significant increase in risk aversion

A credit market that has slammed shut; and

A mood of general depression

The key thing is to know where you are in a cycle:

One way is to use measurable things like:

P/E ratios on stocks

Yields on bonds

Capitalisation ratios on real estate

Cash flow multiples on buyouts

If they are all elevated on historical norms, then they’re usually a precursor to low prospective returns.

Another thing to consider is how investors are behaving

FILL THIS OUT from page 211 on wards.